vermont state tax rate

Base Tax is 2727. Your average tax rate is 1198 and your marginal tax rate is 22.

Buying Cheaper Than Renting But Some Mortgages Make It A Closer Call Trulia S Blog Rent Vs Buy Home Buying Home Ownership

If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

. Local Option Alcoholic Beverage Tax. Including local taxes the Vermont use tax can be as high as 1000. Vermont Income Tax Calculator 2021.

It ranges from 335 to 875. The median property tax in Vermont is 344400 per year for a home worth the median value of 21630000. Passed their school budget and submitted it to Agency of Education and.

State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment of benefits. RateSched-2021pdf 3251 KB File Format. The state sales tax rate in Vermont is 6000.

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. Before sharing sensitive information make sure youre on a state government site. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent.

The Green Mountain State has a steep top income tax rate 875 although most taxpayers dont pay that much. The state also charges a 6 sales tax with some cities levying an additional 1. The FY2023 education property tax rates have been set and are posted below for the towns that have.

Subtract 75000 from 82000. Other local-level tax rates in the state of Vermont are quite complex compared against local-level tax rates in other states. 2021 Income Tax Withholding Instructions Tables and Charts - copy.

Each states tax code is a multifaceted system with many moving parts and Vermont is no exception. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Before sharing sensitive information make sure youre on a state government site.

The Vermont Department of Taxes publishes a report after each legislative session that outlines how legislation impacts taxpayers. State government websites often end in gov or mil. 2020 Vermont Tax Tables.

Read the 2022 legislative highlights to find out what. Tuesday January 25 2022 - 1200. There are a total of 154 local tax jurisdictions across the state collecting an average local tax of 0156.

With local taxes the total sales tax rate. Depending on local municipalities the total tax rate can be as high as 7. Multiply the result 7000 by 66.

The Vermont use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Vermont from a state with a lower sales tax rate. Local Option Meals and Rooms Tax. Employers pay two types of unemployment taxes.

9 Vermont Meals Rooms Tax Schedule. State government websites often end in gov or mil. Vermont has one of the highest average property tax rates in the country with only seven states levying higher property taxes.

Vermont has an individual income tax. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. Vermonts general sales tax rate is 6.

Like most states with income tax it is calculated on a marginal scale with four 4 tax brackets. The Vermont use tax rate is 6 the same as the regular Vermont sales tax. In Vermont the median property tax rate is.

Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. Vermonts tax system ranks 43rd overall on our 2022 State Business Tax Climate Index. The Vermont VT state sales tax rate is currently 6.

The education property tax rates for additional towns will be available once their rates are set. Location Option Sales Tax. Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189.

Enter 3189 on Form IN-111 Line 8. Overview of Vermont Taxes. State and Federal Unemployment Taxes.

6 Vermont Sales Tax Schedule. Vermont Percentage Method Withholding Tables for wages paid in 2020. Average Sales Tax With Local.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as. Vermont Tax Brackets for Tax Year 2020. The site is secure.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. As you can see your Vermont income is taxed at different rates within the given tax brackets. Completed their reappraisal if reappraising in 2022.

Tax Rates and Charts. The highest bracket of 875 starts for income greater than 200000. Counties in Vermont collect an average of 159 of a propertys assesed fair market value as property tax per year.

For Adjusted Gross Incomes IN-111 Line 1. IN-111 Vermont Income Tax. The tax is imposed on sales of tangible personal property amusement charges fabrication charges some public utility charges and some service contracts.

The state tax is payable on the first 15500 in wages paid to each employee during a calendar year. Vermont has a progressive state income tax with a top marginal rate that ranks as one of the highest in the country. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

11182020 13938 PM.

Pin By John Holland On Stupid South Places In America America Places

Pin By Eris Discordia On Economics Capital Market Chart Giant Market

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Advice

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

These Are The Most Educated States In The Country States In America America Education Level

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

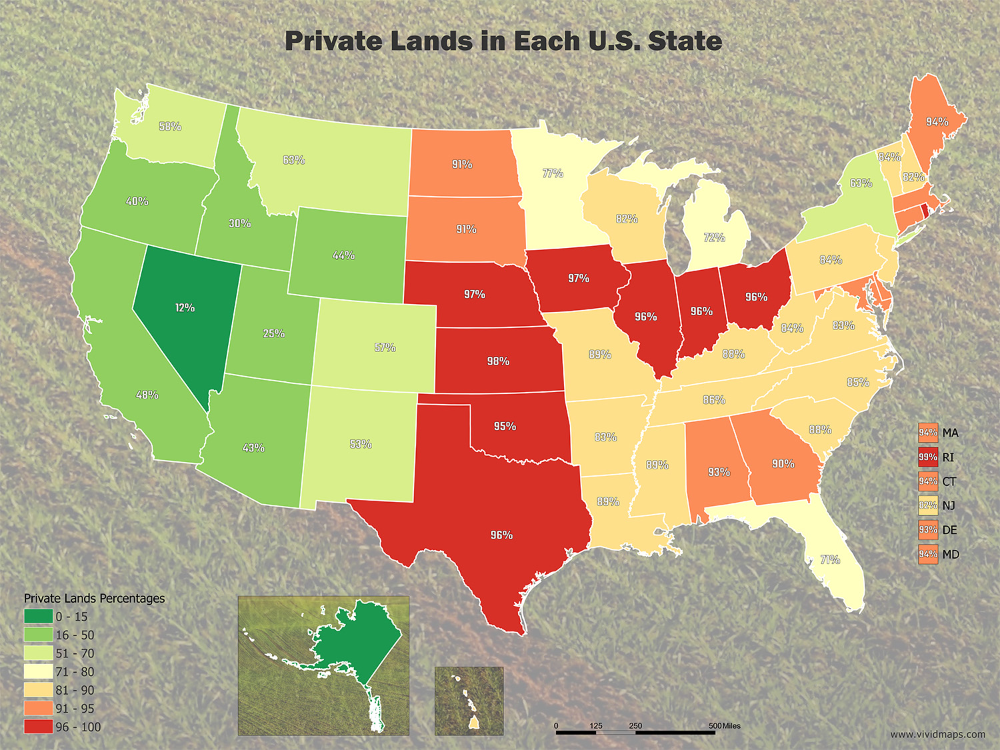

Value Of Private Land In The U S Mapped Vivid Maps Places In America Grand Canyon National Park Us Map

Usa State Taxes 2017 950 5b Usa Veterans Volunteer Services Veteran Owned Business

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

Why New England Is Better Than Florida New England Travel Visiting England Usa Places To Visit

States With The Highest And Lowest Property Taxes Property Tax Tax States

10 Cheapest States For Mortgage Rates Mortgage Rates Mortgage Marketing Trends

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Location Matters Effective Tax Rates On Corporate Headquarters By State Freedom Day Freedom Tax Day

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design